Two years ago a friend, who was in a position to know whereof he/she spoke, told me that Catholic Charities of the Diocese of Rochester had called in an independent auditing firm in an attempt to have its financial statements certified as accurate. My friend went on to add that, after spending some time with Catholic Charities’ books and other financial records, the auditors had pronounced them a mess and refused to grant them their "seal of approval."

This seal of approval usually includes statements to the effect that the auditors (1) had examined the firm’s end-of-year balance sheet as well as income and expense statements and other pertinent records for the year, (2) had checked that the firm had receipts to back up claimed expenses, (3) had satisfied themselves that the firm’s accounting methods were sound, (4) had ascertained, where year-over-year comparisons were made, that the previous year’s numbers also met all the above tests and, finally, (5) were willing to assert that, in their professional opinion, the firm’s financial statements were, in all material aspects, a fair portrayal of the financial position of the firm at year’s end, and that the changes in net assets and the cash flows reported were also materially correct, all in conformity with generally accepted accounting principles. (Examples of such auditor’s statements can be found here and here.)

Catholic Charities’ books apparently couldn’t meet one or more of these criteria in 2008.

When a second and, as far as I can tell, completely independent source recently told me a similar story I decided to do a little digging.

What I found first was a page on the DOR web site with a link that was supposed to take me to Catholic Charities’ "most recent financial statement." Instead of a financial statement, however, that link leads to a copy of Catholic Charities’ 2008 IRS Form 990, which is the return that most larger tax exempt organizations file annually with the IRS.

I didn’t make a serious attempt to wade through the 56 pages of IRS forms and supporting documentation but the first page did show that the return was apparently filed in mid- to late-November, 2009 – many months after its normal due date. In requesting this extension Catholic Charities stated, "as a result of the new form 990 and the size of our organization we are requesting additional time to gather information to ensure the most accurate information is reported." (BTW, anyone wishing to examine this return in detail is welcome to have a go at it. The information here may prove helpful.)

The next thing I found was a web site called GuideStar.org. This site allows registered users (registration is free) to examine the Form 990s and other financial information for a wide variety of charities. When I entered the Employer Identification Number (EIN) shown above (30-0553416) into GuideStar’s search engine, the only thing to come up was Catholic Charities 2007 IRS Form 990, supposedly supplied to GuideStar by the IRS.

This time there were only 23 pages to deal with. I skimmed through the return and found that it was apparently a copy made prior to anyone having signed and dated it, so there was no indication of when it had been filed.

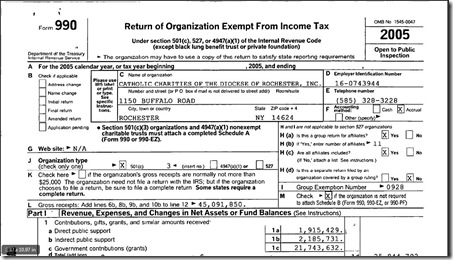

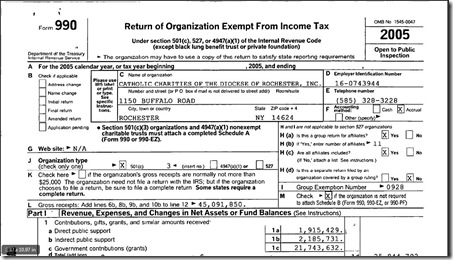

On a whim I entered "catholic charities rochester" into GuideStar’s search engine and found that they had a SECOND listing for "Catholic Charities of the Diocese of Rochester." This listing offered Form 990s for 2005, 2006 and 2007, all supposedly supplied to GuideStar by the IRS.

All three of these returns seem to have been filed in August of the following year. Furthermore, even though they are different in physical appearance, all the income, expense and other numbers reported on the second 2007 return match exactly the corresponding numbers on the first 2007 return.

But the really interesting thing about each of these Form 990s is the EIN: 16-0743944. This is an entirely different EIN than the one appearing on the Form 990 on the DOR site as well as the Form 990 for the first Catholic Charities listing on GuideStar. Just as an individual is only supposed to have one Social Security Number, so too is an organization only supposed to have one EIN. Catholic Charities of the Diocese of Rochester, however, seems to have two.

Now there may be a simple explanation for these multiple EINs, such as the tax preparer simply messing up and entering the wrong one on a couple of forms. Having had some experience in that line of work myself, I can see how something like that can happen.

But what I really find difficult to understand is why an organization like Catholic Charities – which reported almost $53 million in revenue for 2008 and paid its CEO in excess of $153,000 (along with another $20,500 in deferred compensation) that same year – why such an organization cannot get its bookkeeping system organized to the point than an independent auditor would be willing to certify its financial reports.

Sloppy bookkeeping can merely be a sign of carelessness and/or the lack of sufficient oversight, but it can also be used to hide abuses of the system. Either way, there’s no place for it at Catholic Charities.

Someone needs to tell them to shape up.